India’s electric mobility transition has entered a phase of measurable scale and policy maturity. What distinguishes the current moment is not intent, but evidence: Rising adoption numbers, expanding manufacturing capacity and sustained capital flows across vehicle segments. Electric mobility is no longer peripheral to India’s transport strategy it is becoming central to its industrial and urban future.

According to government data, India’s electric vehicle (EV) stock crossed 1.7 million units by the end of 2024, with annual sales growing at over 45% year-on-year. Electric two-wheelers and three-wheelers continue to dominate volumes, accounting for nearly 90% of total EV sales, but growth in passenger cars, commercial vehicles and buses is steadily accelerating. This diversification reflects a broader ecosystem taking shape rather than a single-segment surge.

Policy has played a defining role in this shift. The Faster Adoption and Manufacturing of Electric Vehicles (FAME) programme created the demand backbone for adoption. Under FAME-II, launched in 2019 with an outlay of ₹10,000 crore, subsidies worth over ₹5,200 crore had been disbursed by December 2023. These incentives supported the adoption of more than 1.17 million EVs vehicles and the sanctioning of over 7,000 electric buses for urban transport. Several cities, including Delhi, Bengaluru and Ahmedabad, now operate some of the country’s largest electric bus fleets, signalling institutional acceptance rather than experimentation.

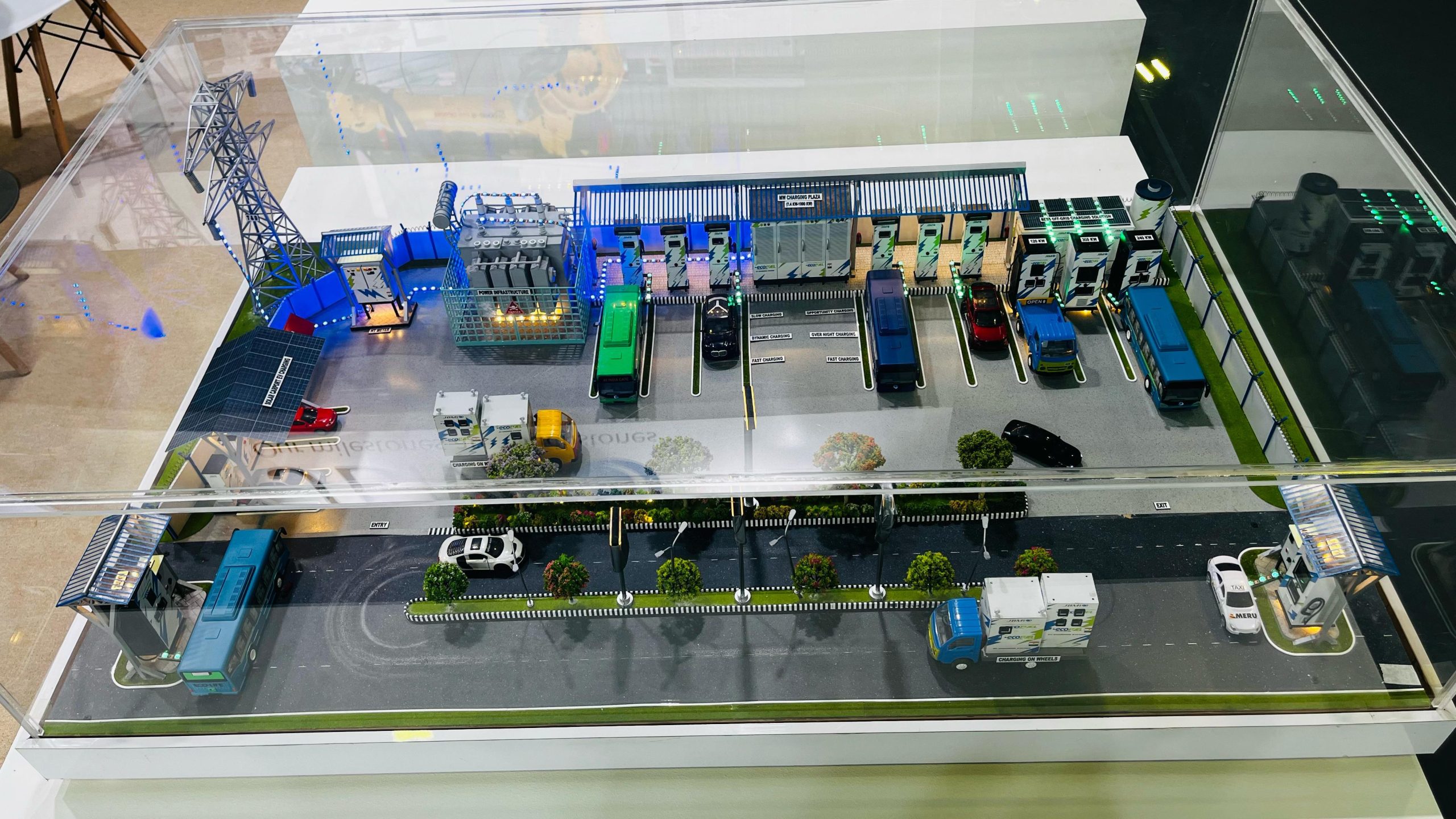

Equally consequential has been the push to localise manufacturing. The ₹18,100-crore Production-Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) batteries targets the creation of 50 GWh of domestic battery capacity enough to support several million EVs annually. Given that batteries account for 35–40% of an EV’s cost, domestic cell manufacturing is critical for long-term affordability and supply-chain resilience.

India’s startup financing ecosystem has reinforced these policy signals. The ₹10,000-crore Fund of Funds for Startups, managed by SIDBI, alongside Startup India and targeted credit guarantees, has channelled capital into EV-focused ventures across battery systems, power electronics, fleet electrification and charging infrastructure. These interventions have helped de-risk early-stage innovation and accelerate commercial deployment.

Private capital has followed with scale. Indian EV startups raised over $1.6 billion in 2022, and total investments again exceeded $1 billion in 2024, despite global funding headwinds. Capital deployment has extended beyond vehicle manufacturing into charging networks, battery pack assembly, indigenous R&D and asset-light models such as fleet leasing and battery-as-a-service. Notably, electric commercial vehicles and last-mile delivery fleets have attracted strong interest as logistics companies target lower operating costs and compliance with tightening emission norms.

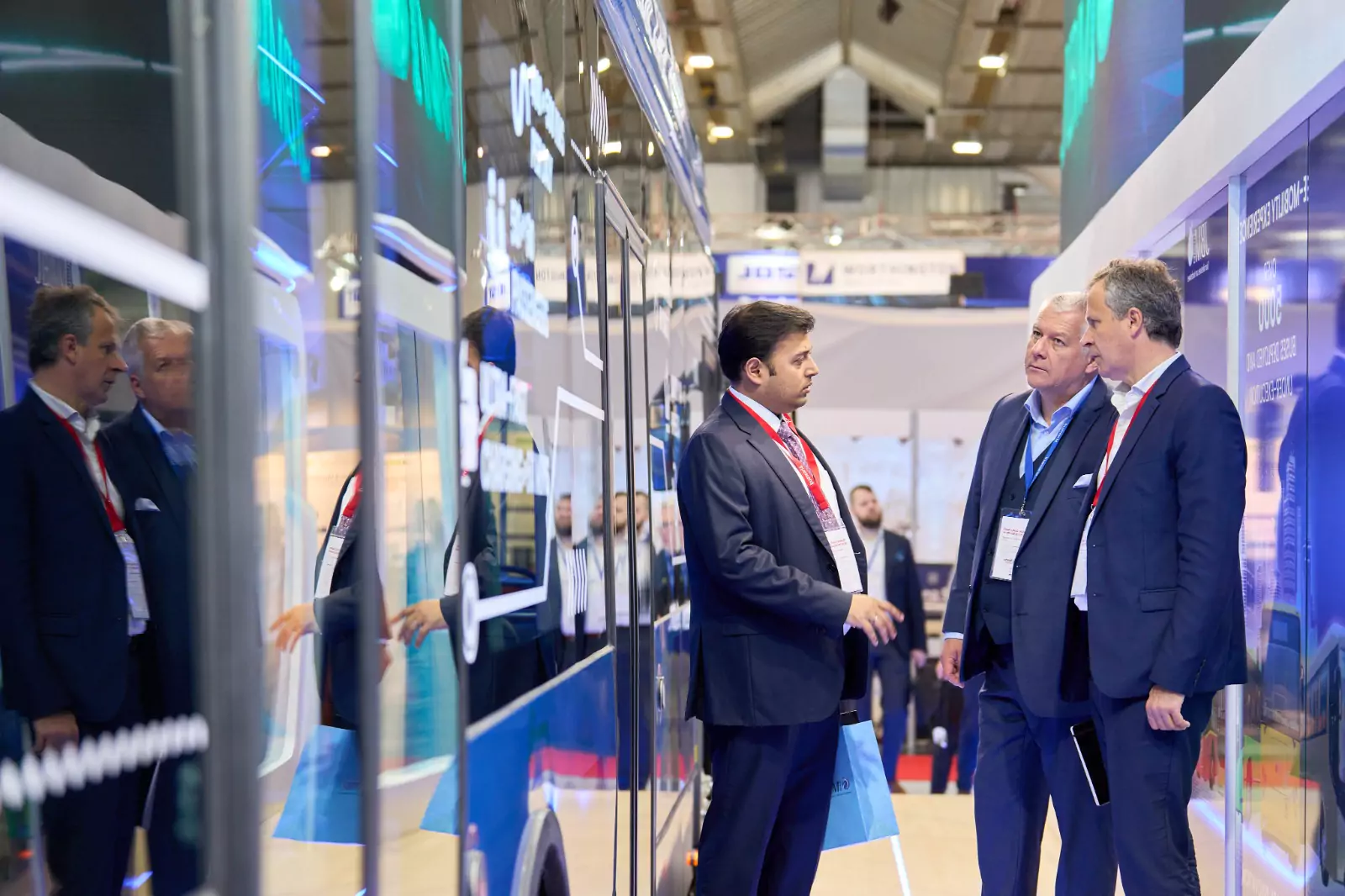

Electric buses illustrate how policy and market logic can converge. Diesel buses typically account for over 30% of urban transport emissions, while electric buses can reduce lifecycle emissions by up to 40%, even on India’s current power mix. With lower energy and maintenance costs over their lifespan, e-buses are increasingly viewed by state transport undertakings as fiscally viable, not just environmentally desirable.

Challenges, however, remain structural. India still imports nearly 100% of its battery-grade lithium and cobalt, charging infrastructure density remains uneven, and upfront vehicle costs continue to deter mass adoption in certain segments. The timely execution of ACC manufacturing projects and a clear policy roadmap beyond FAME-II will be critical to sustaining investor confidence.

Taken together, the data tells a clear story. India’s electric mobility push is no longer about aspiration; it is about delivery. Government policy has reduced early risk, private capital has scaled execution, and industry has begun building domestic capability. The next phase will be defined by how efficiently announced investments translate into operating factories, reliable charging networks and affordable vehicles. Electric mobility in India is no longer an emerging opportunity—it is fast becoming an industrial reality.

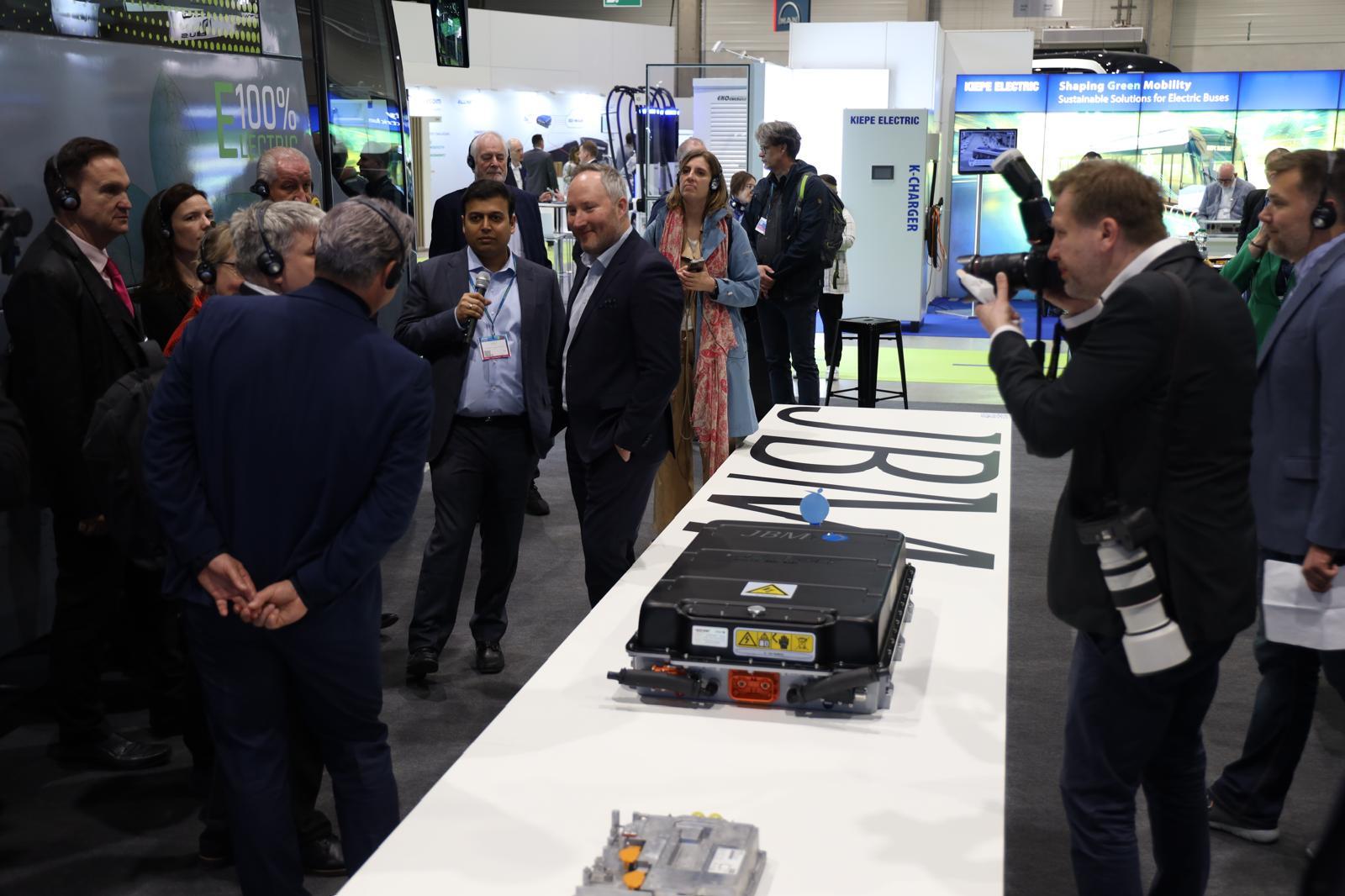

This article is authored by Nishant Arya, chairman, National Council on Green Mobility, ASSOCHAM, vice chairman, JBM Group and chairman, Linde + Wiemann.